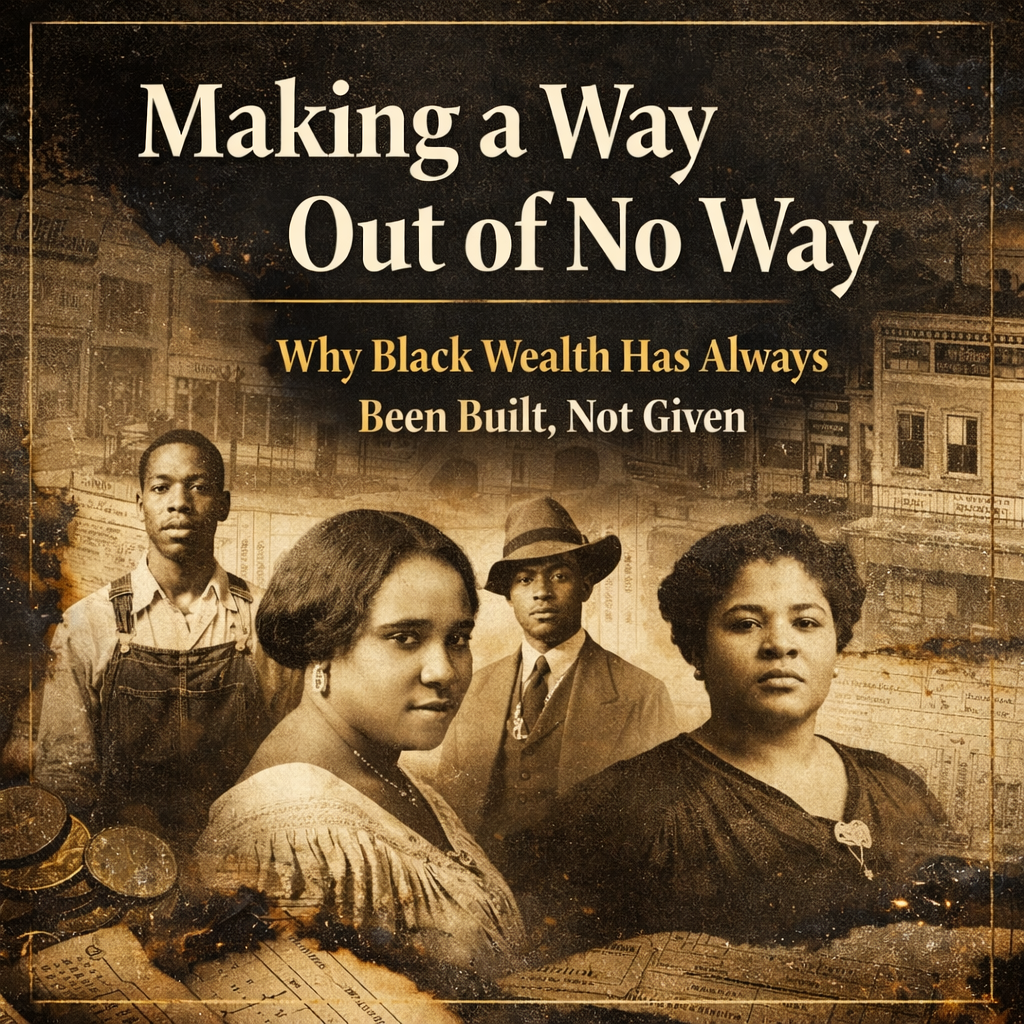

Home of The Grind | Land of The Hustle

At The Urban Profit, we believe wealth is more than dollars. It’s clarity, resilience, peace, and purpose. We break money down in ways that genuinely connect. No jargon. No gatekeeping. Just real tools, real stories, and real strategies for real life.

Whether you’re stacking your first $500, rebuilding your credit, or chasing a bigger entrepreneurial vision, this is your space to learn, reflect, and level up.

The vibe is wealth, and you’re invited to build it with us.

Join The Community!

Stay connected with daily money gems, breakdowns, and real-life game you can actually use.

New here? Start with The Money Move Manual. It’s a free, no-nonsense guide to the habits that create real financial freedom. Download it below and start building momentum today.